by Legacy Wealth | Feb 1, 2017 | Blog, Business Owners, Families, investments, retirement, Savings, Tax Free Savings Account

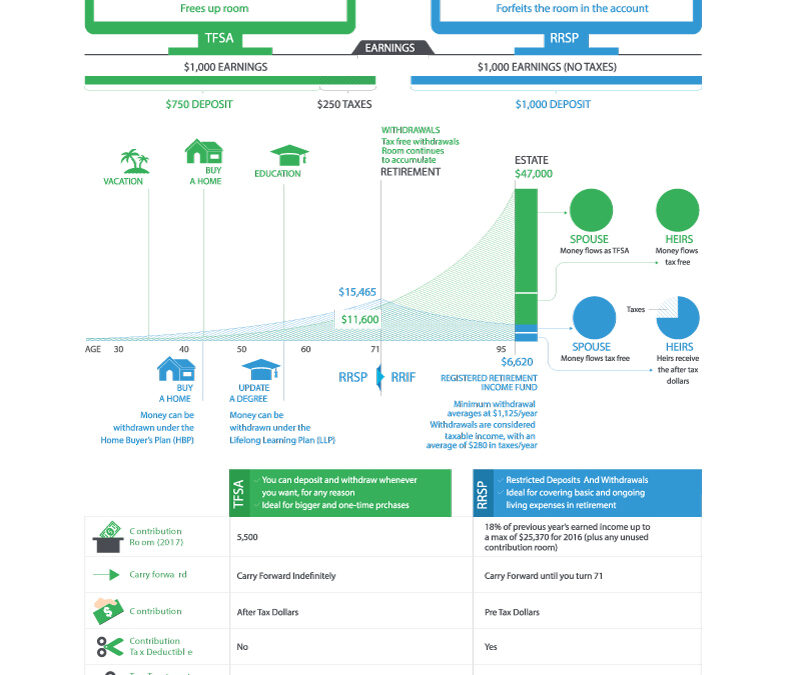

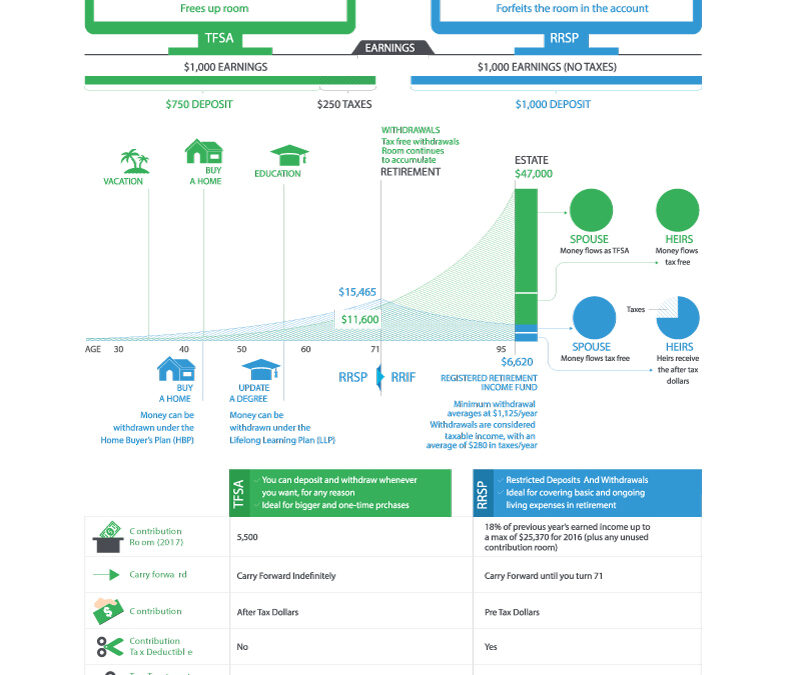

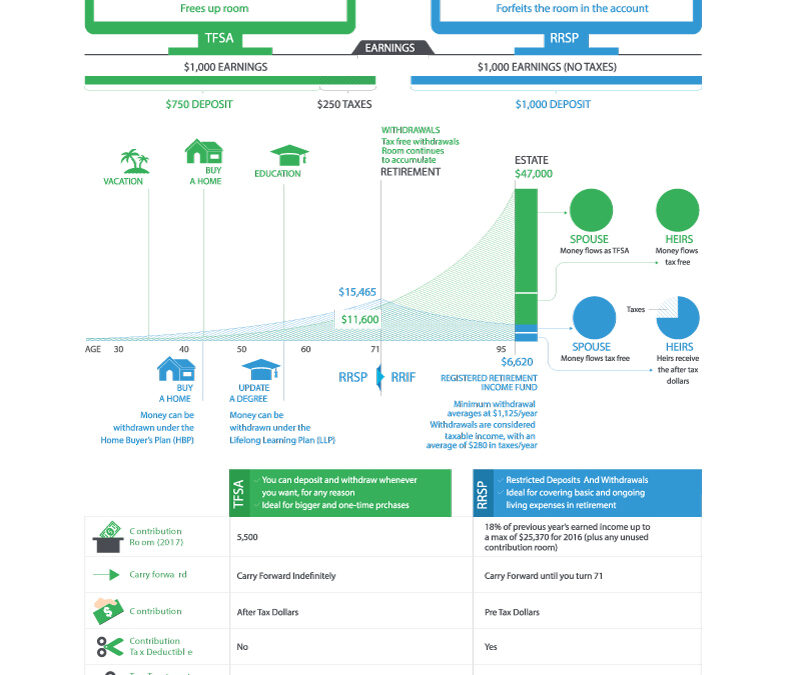

RRSP or TFSA? What’s the difference? With the RRSP deadline around the corner, we’re here to help you figure out where you should invest. Contact us for a complimentary review.

by Legacy Wealth | Nov 10, 2016 | Blog, investments, News

The U.S. Elections – The Morning After Now that the long awaited and anticipated U.S. Elections are over, what now? As improbable as it might have seemed to many, Donald Trump has won the Election and is now the President of the United States of America. We’re not...

by Legacy Wealth | Sep 29, 2016 | investments, Retirees, retirement

In this post I’m going to go over the topic of Spousal RRSPs and how they can help you lower your overall tax rate. This is a strategy that I find is not being used enough and is something that many couples (married, common-law, or same sex) should at least take...

by Legacy Wealth | Aug 13, 2016 | investments, Real Estate

So, we all know that the Banks essentially run the global markets, and Canada is no exception. Therefore, it would naturally be logical to assume that when the heads or executives of the banks, or those in similar high ranking positions make certain moves, we should...

by Legacy Wealth | Sep 4, 2015 | Financial Planning, investments, Retirement Planning

In this series of ‘Investment Basics’, we will go over some of the vehicles Canadians can use to accumulate wealth. Essentially, in Canada, we (generally) have 5 investment vehicles the general public can use to accumulate our assets/wealth: RRSPs, TFSAs (Tax-Free...

by Legacy Wealth | Aug 28, 2015 | investments

We’ve all heard people talk about wealth and how to accumulate it, but it can sometimes seem pretty complicated. Here is a simple formula that I show all my clients which is just the bare basics. The “Wealth Formula”, or the formula to creating...

Recent Comments