by afa | Aug 2, 2021 | Blog, Business Owners, corporate, health benefits, life insurance, long term care, pension plan, rrsp, Tax Free Savings Account

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come...

by Legacy Wealth | Jan 21, 2021 | 2021, Blog, rrsp, Tax Free Savings Account

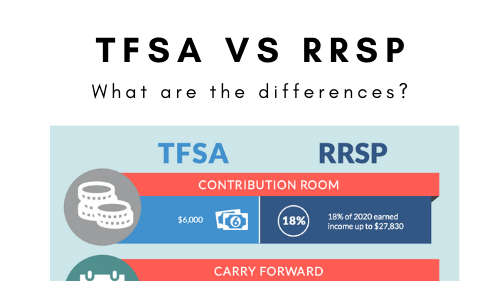

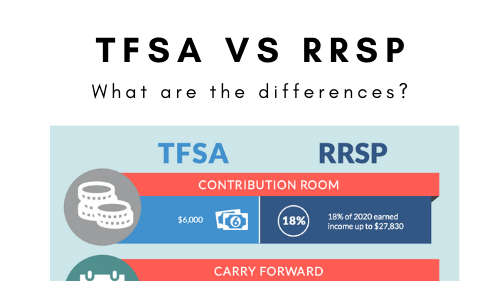

If you are seeking ways to save in the most tax-efficient manner available, TFSAs and RRSPs can provide significant tax savings. To help you understand the differences, we compare: TFSA versus RRSP – Differences in deposits TFSA versus RRSP – Differences...

by Legacy Wealth | Jan 4, 2021 | 2021, Blog, personal finances, rdsp, Registered Education Savings Plan, retirement, rrsp, tax, Tax Free Savings Account

We’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything...

by Legacy Wealth | Dec 2, 2020 | 2020 Only, Blog, Charitable Gifting, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Retired, Coronavirus - Retiring, Coronavirus - Students, disability, Disability Insurance, Family, Financial Advice, Financial Planning, health benefits, pension plan, rdsp, Registered Education Savings Plan, rrsp, tax, Tax Free Savings Account

Now that we are reaching the end of the tax year, it’s an excellent time to review your finances. We’ve listed below some of the critical areas to consider and provide you with useful guidelines. We have divided our tax planning tips into five sections:...

by Legacy Wealth | Aug 31, 2020 | Blog, Business Owners, corporate, Investment, rrsp, Tax Free Savings Account

Investing as a Business OwnerMany business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as: building and protecting your savingsproviding...

by Legacy Wealth | Aug 3, 2020 | Blog, Business Owners, Family, Investment, Retirees, rrsp, Tax Free Savings Account

Retirement planning can be challenging, we’ve outlined what we feel are 6 steps to retirement success.Have a written plan which merges life priorities with financial resources.Consolidate your income-producing assets with one advisor.Layer different sources of...

Recent Comments