THE FIRST YEAR OF PARENTHOOD

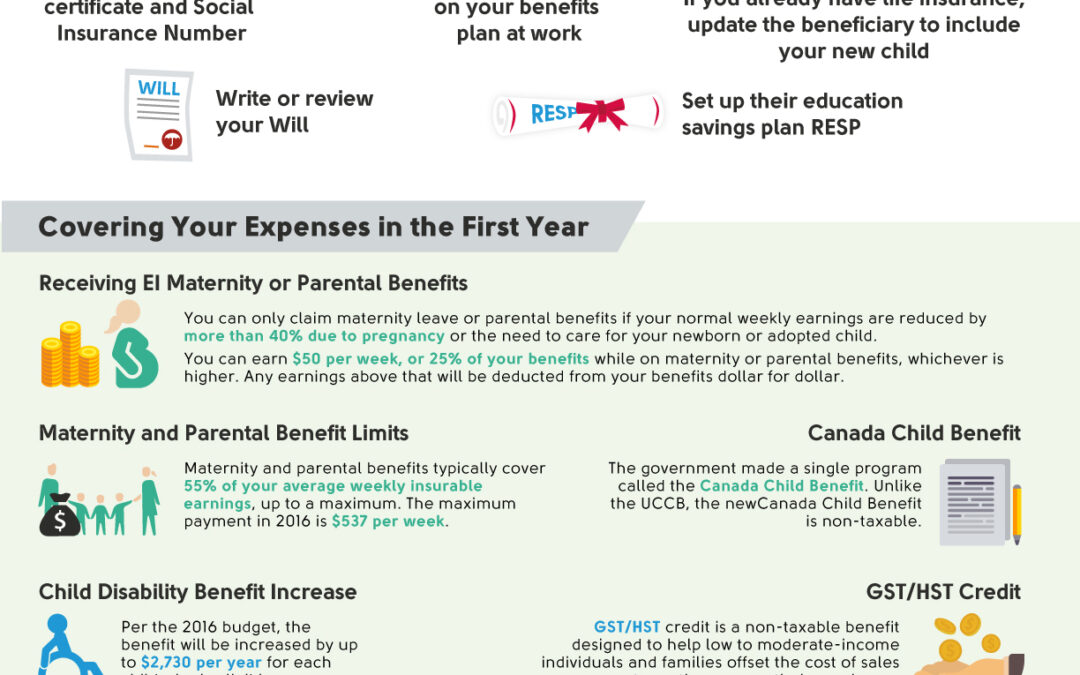

You Just Had A Baby, Now What?

Here Are 5 Things You Need To Do ASAP

- Get your child’s birth certificate and Social Insurance Number

- Update your child on your benefits plan at work

- INSURANCE: If you already have life insurance, update the beneficiary to include your new child

- WILL: Write or review your Will

- RESP: Set up their education savings plan RESP

Covering Your Expenses in the First Year

Receiving EI Maternity or Parental Benefits

You can only claim maternity leave or parental benefits if your normal weekly earnings are reduced by more than 40% due to pregnancy or the need to care for your newborn or adopted child.

You can earn $50 per week, or 25% of your benefits while on maternity or parental benefits, whichever is higher. Any earnings above that will be deducted from your benefits dollar for dollar.

Maternity and Parental Benefit Limits

Maternity and parental benefits typically cover 55% of your average weekly insurable earnings, up to a maximum. The maximum payment in 2016 is $537 per week.

Canada Child Benefit

The government made a single program called the Canada Child Benefit. Unlike the UCCB, the new Canada Child Benefit is non-taxable.

Child Disability Benefit Increase

Per the 2016 budget, the benefit will be increased by up to $2,730 per year for each child who is eligible.

GST/HST Credit

GST/HST credit is a non-taxable benefit designed to help low to moderate-income individuals and families offset the cost of sales taxes they pay on their purchases.

Child Care Expense Deduction

The Child Care Expense Deduction (CCED) allows child care expenses such as daycare that allow you to return to work to be deducted from your income for tax purposes.

Child’s Age (at the end of the tax year) Limit per Child

6 or under $8,000

7 to 16 $5,000

Over 16 with mental or physical impairment if disability cannot be claimed $5,000

Any age for whom disability amount can be claimed $11,000

As an example, if the lower-income parent in your family earned $24,000 for the tax year, your child care expenses claim cannot exceed $16,000.

Contact us to see how we can help.

Recent Comments