by Legacy Wealth | Sep 1, 2018 | Blog, Business Owners, Families, individuals, life insurance

As our lives grow and change with variable circumstances, new additions, and job transitions, our needs for insurance will also evolve. Additionally, economic fluctuations and external circumstances that influence your insurance policy will need frequent re-evaluation...

by Legacy Wealth | May 1, 2018 | Business Owners, Families, individuals, life insurance, permanent insurance, term insurance

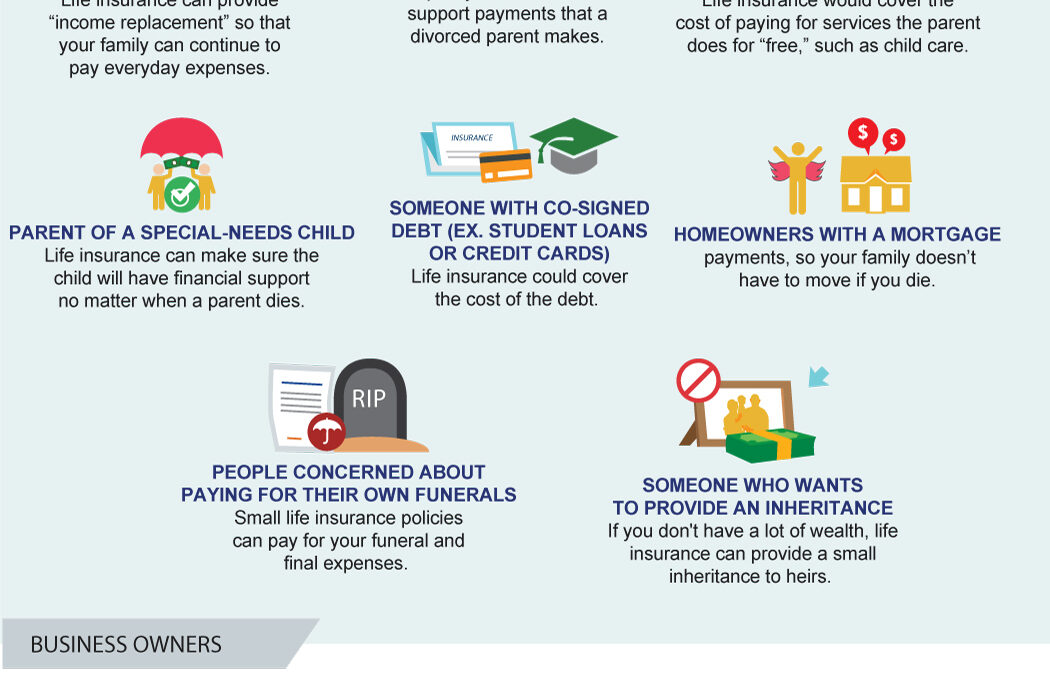

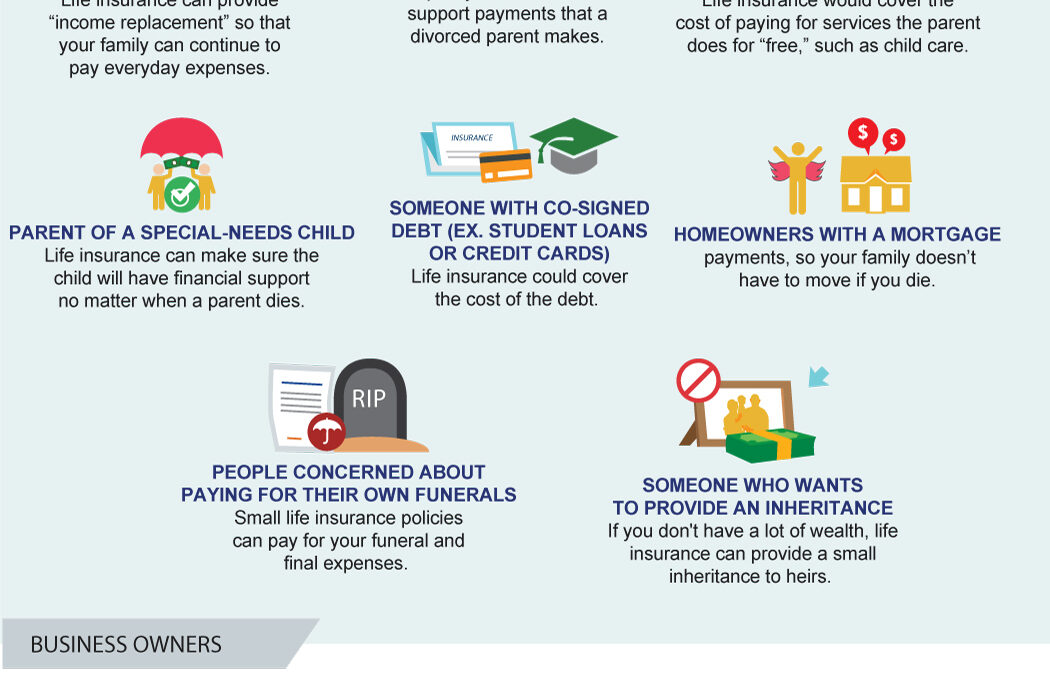

You most likely do, but the more important question is, ‘What kind?’ Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your...

by Legacy Wealth | Aug 1, 2017 | Blog, Business Owners, Families, individuals, life insurance, permanent insurance, term insurance

You most likely do, but the more important question is, ‘What kind?’ Whether you’re a young professional starting out, a devoted parent or a successful CEO, securing a life insurance policy is probably one of the most important decisions you will have to make in your...

by Legacy Wealth | May 3, 2017 | Blog, Budget, Business Owners, Employees, Families, individuals, tax

Ontario Finance Minister Charles Sousa delivered the province’s 2017 budget on April 27, 2017. The province’s 2017 budget is balanced, with projected balanced budgets for 2018 and 2019. Corporate Income Tax Measures No changes to corporate taxes were announced....

by Legacy Wealth | May 1, 2017 | Blog, Business Owners, Estate Planning, Families, individuals

These 4 reasons will compel you to revisit your estate planning For most of the people, a watertight estate planning means finding the best ways to equip themselves for contingencies, reduce the tax liability for their estate, and signing up for investment plans to...

by Legacy Wealth | Mar 27, 2017 | Blog, Budget, Families, individuals, tax

Finance Minister Bill Morneau delivered the government’s 2017 federal budget on March 22, 2017. The budget expects a deficit of $23 billion for fiscal 2016-2017 and forecasts a deficit of $28.5 billion for 2017-2018. Find out what this means for families. Key points...

Recent Comments